Professional Employer Organizations (PEOs) are game-changers for businesses looking to streamline their operations and maximize growth. As a strategic partners, PEOs handle various tasks, such as HR management, payroll, benefits administration, and even compliance.

Table of Contents

- What are Professional Employer Organizations?

- What are Certified Professional Employer Organizations?

- Services offered by Professional Employer Organizations

- What Professional Employer Organizations don’t do?

- How much does the PEO services cost?

- What are the benefits of using a PEO?

- Differences between PEOs and other services.

- What size of businesses can partner with Professional Employer Organizations?

- What kind of businesses will benefit the most from Professional Employer Organizations?

- Pros and Cons of partnering with a Professional Employer Organization.

- What are the largest Professional Employer Organizations in the US?

- How to choose the right PEO?

- Who is a PEO Broker?

- What is the cost of working with a PEO Broker?

- PEO faq’s.

What Are Professional Employer Organizations?

The question “What are professional employer organizations?” can be simply answered as PEOs are firms that allow businesses to outsource their HR functions, giving them more time and resources to focus on growth and success.

A Professional Employer Organization (PEO) is an outsourcing company that provides comprehensive HR solutions to small and medium-sized businesses.

What does a Professional Employer Organization do?

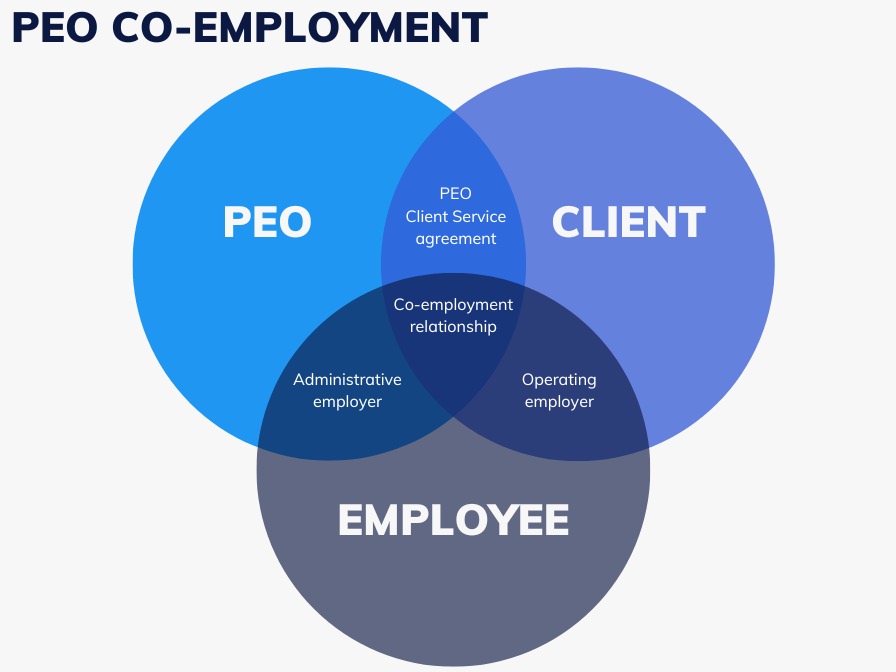

By establishing a co-employment relationship with their clients, PEOs assume certain employer responsibilities, such as payroll administration, benefits management, and risk management, while the business retains control over day-to-day operations and decision-making.

Partnering with a PEO can be a smart move for businesses.

They’ll not only take care of the nitty-gritty details but also help ensure your company stays compliant with ever-changing regulations. By the end of this post, you’ll have a firm understanding of what professional employer organizations are, and how they can benefit your business.

What Are Certified Professional Employer Organizations?

Certified Professional Employer Organizations (CPEOs) are specialized entities recognized and certified by the Internal Revenue Service (IRS) in the United States.

These organizations provide comprehensive human resource (HR) solutions and employment services to client companies.

The certification process is completely voluntary for PEOs.

Once Certified, the CPEOs can then advertise and promote themselves at a higher level. It is important to consider this certification by clients looking to partner with a PEO since this will provide peace of mind to them that the PEOs are handling the tax liabilities properly on their behalf.

Services Offered by Professional Employer Organizations

As a business owner, one of the most challenging aspects of managing your company is handling all of the administrative tasks that come with it. From payroll to benefits to human resources, there are countless responsibilities that must be taken care of to keep your business running smoothly. This is where a Professional Employer Organization (PEO) can be a valuable asset to your company. PEOs offer a wide range of services that can help you manage these tasks more efficiently and effectively.

Payroll Processing

One of the primary services offered by PEOs is payroll processing. This is the necessary staple that creates the co-employment relationship with the PEO. It includes tasks such as calculating employee wages, deducting taxes and other withholdings, and issuing paychecks or direct deposits as well as issuing W2s at year’s end. By outsourcing your payroll processing to a PEO, you can save time and ensure that your employees are paid accurately and on time.

Employee Benefits

Another area where PEOs can be particularly helpful is in managing employee benefits. PEOs can help you find and select the best benefits packages for your employees, including health insurance, retirement plans, and more. They can also handle administrative tasks such as enrollment, claims processing, and compliance with government regulations.

HR Support

PEOs can also provide valuable support for your human resources department. This includes tasks such as recruiting and hiring new employees, developing and implementing HR policies and procedures, and ensuring compliance with employment laws and regulations. By outsourcing these tasks to a PEO, you can free up valuable time and resources to focus on growing your business.

Risk Management and Compliance

Finally, PEOs can help your company manage risk and ensure compliance with various regulations. This includes tasks such as maintaining accurate records, handling workers’ compensation claims, and managing unemployment insurance. By partnering with a PEO, you can reduce the risk of legal and financial issues and ensure that your company operates according to all applicable laws and regulations.

Overall, Professional Employer Organizations offer a wide range of services that can help your business run more smoothly and efficiently. By outsourcing administrative tasks such as payroll processing, employee benefits, HR support, and risk management and compliance, you can focus on growing your business and achieving your goals.

What Professional Employer Organizations Don’t Do?

- Marketing: This is a component of running a business that PEOs do not handle for clients however because they help in other key areas, clients have more time to focus on this important business aspect.

- Strategic decision-making: PEOs generally focus on administrative and operational HR functions rather than making strategic decisions for a client company. Strategic planning, business development, and high-level decision-making typically remain the responsibility of the client’s management team.

- Ownership of employees: While PEOs assist with various HR functions and co-employment arrangements, they do not assume ownership of client company employees. The client company remains the employer of record, retaining control over hiring, firing, promotions, and overall employment decisions.

- Financial management: PEOs may handle certain financial aspects related to payroll, tax withholding, and benefits administration. However, they may not be responsible for the overall financial management of the client company, such as accounting, financial reporting, budgeting, or financial strategy.

- Legal compliance: PEOs can provide guidance and assistance with compliance matters, but the ultimate responsibility for legal compliance rests with the client company. PEOs typically do not assume legal liability for client company actions or non-compliance with employment laws and regulations.

- Business-specific expertise: PEOs often serve clients from various industries, but they may not possess specialized knowledge or expertise specific to a particular business or industry. Client companies may need to rely on their own internal resources or seek external expertise for industry-specific HR challenges.

It’s important to note that the specific services and limitations of PEOs may vary depending on the provider and the terms of the agreement between the PEO and the client company. Therefore, it’s advisable to consult with the PEO and review the terms of their service agreement to understand the scope of their offerings and limitations.

How Much Does The PEO Services Cost?

The cost of working with a PEO varies depending on the size of your business, the services you need, and the PEO you choose. Typically, PEOs charge either a percentage of your payroll, ranging from 2-12%, or a fixed per-employee-per-month (PEPM) administrative fee.

If your company is in a blue-collar industry, often a percentage of payroll is customary for PEOs to charge clients. If your company focuses primarily in a white-collar industry and/or your employees are highly compensated, partnering with a PEO that charges a fixed per-employee-per-month administrative fee is more cost-effective and makes a lot more sense. Depending on the number of employees you have this administrative fee can range from $80 – $250 per employee per month with the average roughly at around $120 per employee per month (PEPM). The more employees you have, the lower this PEPM becomes.

What are the benefits of using a PEO?

As a small business owner, it can be challenging to manage all aspects of your business, including human resources. Professional employer organizations (PEOs) offer a solution that can help you save time and money while providing your employees with better benefits. Here are some of the key benefits of using a PEO:

Access to Better Benefits At Lower Cost

One of the primary advantages of using a PEO is the access to better benefits for your employees often comparable to Fortune 500 companies. PEOs typically offer comprehensive employee benefits packages that include health insurance, retirement plans, and other benefits that small businesses may be unable to afford on their own. By pooling the resources of multiple small businesses, PEOs can negotiate better rates and provide better benefits than individual companies can on their own.

Reduced Administrative Burden And Cost

Managing human resources can be a time-consuming and complex process. By partnering with a PEO, you can outsource many of the administrative tasks associated with HR, such as payroll processing, tax filing, and benefits administration. This can free up time to focus on other aspects of your business and help you avoid costly mistakes that can result in fines or legal liabilities.

HR Support

- PEOs provide access to experienced HR professionals who can offer guidance on compliance with employment laws, best practices in recruitment and employee management, and resolving employee issues.

Enhanced Payroll and Tax Management:

- Streamlined payroll processes: PEOs handle payroll calculations, tax withholdings, and filings, ensuring accurate and timely payments to employees and government agencies.

- Reduced tax and reporting risks: PEOs assume responsibility for payroll tax compliance, reducing the risk of errors and penalties associated with tax filings.

Enhanced Compliance

Staying compliant with federal and state HR regulations can be a challenge for small businesses, especially those with limited resources. PEOs can help you stay up-to-date with the latest regulations and ensure that your business is in compliance. They can also provide guidance on complex issues such as workers’ compensation and employee classification.

Improved Recruiting and Retention

Attracting and retaining top talent is essential for the success of any business. PEOs can help you improve your recruiting and retention efforts by offering better benefits and HR support. They can also provide access to HR technology tools that can streamline your hiring process and help you find the right candidates more quickly.

In conclusion, partnering with a PEO can be a smart move for small businesses looking to save time and money while providing better benefits to their employees. By outsourcing HR tasks and leveraging the resources of a PEO, you can focus on growing your business and achieving your goals.

Differences Between PEOs and Other Services

The one key difference that distinguishes PEO services from others is that PEOs when partnering with their clients enter into a co-employment relationship. Almost all other options do not. In a PEO (Professional Employer Organization) co-employment relationship, a PEO enters into an agreement with a client company to assume certain employer responsibilities and liabilities for the client’s employees. The PEO handles the various HR functions, while the client retains control over the day-to-day activities and management of the employees.

The PEO co-employment relationship offers several potential benefits. The client gains access to the PEO’s HR expertise, resources, and technology, which can streamline HR processes and allow the client to focus on core business activities. Employees may benefit from improved HR services, access to better benefits packages, and professional HR support through the PEO.

Other service providers that do not provide a co-employment relationship are HROs, ASOs, HR Software providers, and Payroll Processing Companies.

HROs

An HRO (Human Resources Outsourcing) refers to the practice of outsourcing specific HR functions or processes to an external service provider.

In an HRO arrangement, a company contracts with a third-party provider to handle various HR tasks, such as payroll administration, benefits management, recruitment, training and development, performance management, and other HR-related functions.

The HRO provider assumes responsibility for these functions, allowing the client company to focus on its core business activities while benefiting from the expertise, resources, and efficiencies offered by the external HR service provider. No employee benefits are offered by them.

ASOs

An ASO (Administrative Services Organization) is a type of outsourcing arrangement where a company partners with an external service provider to handle administrative tasks and functions related to human resources, payroll, benefits administration, and other back-office operations.

Unlike a PEO, an ASO does not assume co-employment or employer of record status. Instead, the ASO acts as a consultant or service provider, offering expertise, technology, and support in managing administrative tasks, while the client company maintains full control over the employment relationship and HR decision-making.

The ASO arrangement allows companies to access specialized administrative services and resources, streamline operations, and improve efficiency without transferring employer responsibilities or altering the employment structure.

HR Software provider

An HR software provider is a company that specializes in developing and offering software solutions designed to automate and streamline various human resources functions and processes.

These providers develop and maintain software platforms or applications that assist HR professionals in managing tasks such as employee data management, payroll processing, benefits administration, recruitment and applicant tracking, performance management, training and development, and other HR-related activities.

The HR software provided by these companies aims to enhance efficiency, accuracy, and compliance within HR departments, enabling organizations to effectively manage their workforce and optimize HR operations through technology-driven solutions.

Also unlike PEOs, there is no co-employment relationship or employee benefits offered through them.

Payroll Processing Company

Lastly, a payroll processing company is a specialized service provider that handles the end-to-end processing of employee payroll on behalf of organizations.

These companies manage all aspects of payroll, including calculating wages, withholding taxes, deducting benefits, and issuing payments to employees.

They ensure compliance with relevant tax laws and regulations, handle payroll tax filings, generate reports, and provide comprehensive payroll-related services. B

y outsourcing payroll to a dedicated company, organizations can streamline their payroll operations, reduce administrative burdens, minimize errors, and ensure timely and accurate payment of employees while staying compliant with payroll regulations.

Again, no co-employment or employee benefits are offered through them.

What Size of Businesses Can Partner With Professional Employer Organizations?

As a business owner, you may wonder whether partnering with a professional employer organization (PEO) is the right choice for your company.

One of the biggest questions on your mind may be what size of businesses can partner with a PEO.

In this section, we’ll explore the different sizes of businesses that can benefit from partnering with a PEO. One key statistic we found is that the average PEO client has about 30 employees.

Having said that, we found PEOs have clients as small as 2 employees and as large as in the thousands but that is much more unusual.

Small Businesses

Small businesses with fewer than 100 employees are often the most in need of HR support but may not have the resources to hire a full-time HR staff.

This is where partnering with a PEO can be extremely beneficial.

PEOs offer a range of HR services, including payroll processing, employee benefits, and compliance support. By partnering with a PEO, small businesses can streamline their HR processes and focus on growing their business.

Medium-Sized Businesses

Medium-sized businesses with a number of employees between 50 and 250 may have an HR team, but may still struggle with managing all of their HR functions.

Partnering with a PEO can help alleviate this burden by providing additional HR support.

PEOs can also offer cost savings on employee benefits, such as health insurance and retirement plans, due to their economies of scale.

Large Businesses

Large businesses with over 250 employees to the thousands will most likely already have an established HR department, but may still benefit from partnering with a PEO.

PEOs can offer additional support for specific HR functions, such as risk management and compliance support. They can also provide access to their network of HR professionals and resources.

In summary, businesses of all sizes can benefit from partnering with a professional employer organization.

Whether you’re a small business that needs additional HR support, a medium-sized business looking to save on employee benefits, or a large business in need of specialized HR assistance, a PEO can help streamline your HR processes and support your business growth.

What Kind of Businesses Will Benefit The Most From Professional Employer Organizations?

As a business owner, you know that managing HR tasks can be time-consuming and often take focus away from your core business activities. This is where a Professional Employer Organization (PEO) can come in handy!

Small Businesses

Small businesses can greatly benefit from PEO services.

Typically, these businesses don’t have the resources to handle HR tasks like payroll, benefits administration, and compliance on their own. By partnering with a PEO, small businesses can access the HR expertise and technology they need to grow their business without having to worry about administrative tasks.

New Businesses

Startups and new businesses often have limited resources and need to prioritize their spending.

Partnering with a PEO can help these businesses focus their resources on growth and development while leaving HR tasks to the experts. PEOs can provide comprehensive HR services at a lower cost than hiring an in-house HR team, making it an attractive option for new businesses.

Also, PEOs can immediately make the new business easily scalable, placing the infrastructure for them as a turn-key solution.

Growing Businesses

As businesses grow, so do their HR needs. Hiring new employees, managing benefits and compliance, and handling payroll can become overwhelming for a growing business.

By partnering with a PEO, businesses can scale their HR services to meet their growing needs and focus on their core business activities.

Businesses in Regulated Industries

Businesses operating in regulated industries, such as healthcare and finance, have unique HR compliance needs.

PEOs offer compliance expertise and can help ensure that businesses in these industries meet all regulatory requirements. This allows businesses to focus on providing high-quality services to their customers without worrying about compliance issues.

In conclusion, many businesses in various industries can benefit from partnering with a Professional Employer Organization. Whether you are a small or new business, or a growing business in a regulated industry, a PEO can provide the HR expertise and technology you need to succeed.

Professional Employer Organization Pros and Cons

Partnering with a Professional Employer Organization (PEO) can be a great way for small businesses to streamline their HR operations and reduce administrative tasks. However, like any business decision, there are pros and cons to consider before deciding if a PEO is right for your organization.

Potential Pros of Partnering With a PEO

Clients who select the right PEO can gain significant benefits. This is why it is important to do your due diligence and/or work with a PEO broker prior to choosing the PEO solution.

- Access to Better Benefits: PEOs can offer a wide range of employee benefits and perks that may not be available to businesses on their own.

- Reduced Administrative Burden: By outsourcing HR tasks to a PEO, business owners can reduce the amount of time they spend on administrative tasks and focus on growing their business.

- Expert HR Advice: PEOs have HR experts on staff who can provide guidance and advice on everything from compliance to employee relations.

- Total Cost Savings and Lower Employment Costs: PEOs can leverage their size to negotiate better rates for employee benefits and insurance, which can lead to lower employment costs for businesses. This allows clients who partner with a PEO not only all the benefits of the PEO relationship but at a lower total cost.

Potential Cons of Partnering With a PEO

Clients who do not select the right PEO can fall into some pitfalls. This is why it is important to do your due diligence and/or work with a PEO broker prior to choosing the PEO solution. Here are Professional Employer Organization disadvantages:

- Limited Control Over HR Operations: When partnering with some PEOs, businesses relinquish some control over HR operations. Again, not all PEOs are created equal.

- Increased Costs: While partnering with a PEO can lead to lower employment costs, there are administrative fees associated with outsourcing HR tasks to a third-party provider. Sometimes, this leads to higher costs.

- Shared Liability: When partnering with a PEO, small businesses share liability for compliance and other HR-related issues with the PEO. Most clients see this as a positive but companies who prefer complete control of every detail are less likely to see it that way.

- Less Personalized Service: PEOs work with multiple clients, which means that small businesses may not receive the same level of personalized service they would from an in-house HR team. Some PEOs are better than others at providing a white glove level of service.

Overall, partnering with a PEO can be a great way for businesses to improve their HR operations and reduce administrative tasks. However, it’s important to weigh the pros and cons before making a decision to ensure that a PEO is the right fit for your organization.

Largest PEO Companies in the US

As more and more companies look for ways to streamline their HR functions, Professional Employer Organizations (PEOs) are quickly becoming a popular solution. PEOs offer a wide range of HR services to businesses, including payroll processing, benefits administration, risk management, and more. Here we take a look at the five largest PEO firms in the USA.

1. ADP TotalSource

ADP TotalSource is one of the largest PEOs in the country, serving over 700,000 employees across thousands of businesses. The company offers a comprehensive suite of HR services, including HR management, payroll processing, benefits administration, and more. With over 70 years of experience in the industry, ADP TotalSource has a proven track record of helping businesses grow and thrive.

2. Insperity

Insperity is another major player in the PEO space, serving over 100,000 businesses across the country. The company’s services include HR administration, payroll processing, employee benefits, and more. In addition to its PEO services, Insperity also offers business performance solutions to help companies improve their operations and increase profitability. They excel in providing clients with one of the top HR support representative teams. They pride themselves as the industry’s white glove solution.

3. TriNet

Founded in 1988, TriNet is a well-established PEO that caters to businesses of all sizes. They primarily service the white-collar space dominating the financial industry. The company offers a range of HR services, including payroll processing, benefits administration, risk management, and more. With a focus on technology, TriNet provides businesses with advanced HR tools and analytics to help them make data-driven decisions.

4. Paychex

Paychex is a leading PEO that offers a range of HR services to businesses of all sizes. The company’s services include payroll processing, HR administration, benefits administration, and more. Paychex also offers a range of business solutions, including accounting software, time and attendance tracking, and more. They are also a top contender with their price-sensitive solution.

Although the above PEOs are all publicly traded companies and also the largest PEOs, it does not mean that these 4 PEOs are always the best options to choose from. There are hundreds of PEOs in the US.

Some PEOs specialize in various different industries and perhaps one of them is more suited to those industries’ specific needs.

All PEOs have strengths and weaknesses and the above 4 PEOs are no exemption.

The best way to determine that is to seek the assistance of an expert professional such as a PEO broker to help you get to the right solution avoiding a long process of trial and error.

How to choose a PEO?

Choosing the right Professional Employer Organization (PEO) can be a daunting task, especially for business owners who may not be familiar with the concept.

Here are some factors to consider when choosing the right PEO for your business:

Services Offered

When selecting a PEO, it is important to consider the services offered. A PEO typically offers services such as payroll, benefits administration, and HR management.

However, some PEOs may offer additional services, such as recruitment and training. Determine which services your business needs and choose a PEO that can provide those services.

Experience and Reputation

Experience and reputation are crucial when selecting a PEO. Look for a PEO who has been in business for a significant amount of time and has a proven track record of success. Research the PEO’s reputation online by reading customer reviews and testimonials.

Technology and Integration

Technology and integration are also important factors to consider when selecting a PEO. Choose a PEO that uses modern technology and can easily integrate with your existing systems. This will help streamline processes and minimize the risk of errors.

Cost

Cost is a significant factor when choosing a PEO.

Determine your budget and choose a PEO that can provide the services you need within your budget.

Keep in mind that the lowest cost option may not always be the best choice.

Customer Service

Last but not least, customer service is an essential factor when selecting a PEO.

Choose a PEO that provides excellent customer service and is responsive to your needs.

This will ensure that you can rely on the PEO to provide the support you need to run your business effectively.

In summary, choosing the right PEO requires careful consideration of several factors.

By taking the time to research and evaluate your options, you can select a PEO that meets the needs of your business and helps you achieve your goals.

Because of all the many different factors to consider, many businesses seek a professional to help them source the many options available. Typically a PEO Broker is the best-suited advisor to do all the heavy lifting needed to find the most appropriate solution.

Who is a PEO Broker?

In the United States, there are over 700 operational Professional Employer Organizations.

Selecting the appropriate one for your business is a challenging task.

To secure the most favorable terms for your business, you will need to reach out to multiple PEOs, complete numerous forms for each one, and submit all the necessary documents.

Upon receiving proposals from various Professional Employer Organizations, you will need to carefully evaluate them.

Proposals vary among PEOs and lack standardization, making it difficult to conduct a proper comparison.

Overall, the process of finding an appropriate PEO partner requires extensive research and analysis, particularly for small businesses with limited resources.

This is where the assistance of a Professional Employer Organization (PEO) Broker becomes valuable.

What is a PEO Broker?

A PEO broker is a professional who helps match businesses with the right PEO provider.

They act as a middleman between the PEO provider and the business owner, helping to simplify the process of selecting and implementing a PEO solution.

What Does a PEO Broker Do?

PEO brokers work with businesses to understand their unique needs and match them with a PEO provider that can meet those needs. They help companies navigate the complex world of HR outsourcing, providing guidance and support through every step of the process.

PEO brokers also help businesses compare different PEO providers and plans, ensuring that they get the best possible deal. They can negotiate on behalf of the business owner, helping to secure better rates and terms.

Why Work with a PEO Broker?

Collaborating with a PEO broker offers businesses the advantage of saving both time and money. Brokers possess extensive expertise in the PEO industry, enabling them to assist businesses in discovering the most cost-effective HR solutions.

Furthermore, brokers help businesses avoid costly errors, such as choosing a PEO provider that does not align with their requirements.

In addition to cost-effective solutions, PEO brokers provide continuous support to businesses, ensuring they derive maximum benefits from their PEO arrangement. Whenever issues arise, brokers guide and support businesses through the process.

When it comes to outsourcing HR functions, a PEO broker serves as a valuable asset for businesses. They aid in identifying the appropriate PEO provider, negotiating favorable rates and terms, and offering ongoing support.

What is the cost of working with a PEO Broker?

The vast majority of PEO brokers are compensated by the PEO solution the client implements so to the client their services are 100 percent complementary.

Even though the PEO broker is the middleman, the PEOs do not tack on an extra fee to the client to cover the PEO broker’s commissions.

Since the client acquisition cost to the PEO is negligible, the PEOs are more than happy to share a little of the revenue with the PEO brokers. This in turn is a win-win for the client since they get the expertise of the PEO broker for free.

If you are contemplating outsourcing your HR functions, engaging the services of a PEO broker from The Huldisch Group can bridge the gap and help you find the ideal match.

We are PEO brokers who have a deep understanding of the PEO industry and can help you identify the factors that are most important to you in a PEO partner.

Our services are free to you, and we are confident that we can help you find the right PEO to partner with.

In conclusion, Professional Employer Organizations (PEOs) are a great way for small and medium-sized businesses to outsource their human resource management, payroll, and benefits administration.

With a PEO, you can focus on growing your business while the PEO takes care of the administrative tasks associated with being an employer.

PEOs also offer access to better healthcare benefits, retirement plans, and worker’s compensation insurance.

They can also help with compliance issues and reduce liability for your business. Overall, PEOs are a cost-effective and efficient way to manage your workforce and help your business thrive.

PEO FAQ

Here are some frequent questions we receive from our clients before partnering with PEO.

Q: Can a PEO help me with compliance?

A: Yes, a PEO can help you stay compliant with employment laws and regulations. They will keep track of changes in laws and regulations and make sure your business stays in compliance.

Q: Can a PEO help with hiring and firing employees?

A: Yes, a PEO can assist with the hiring and firing process. They can provide guidance on hiring best practices and help you terminate employees according to legal requirements.

Q: Can I customize the services I receive from a PEO?

A: Yes, many PEOs offer customizable service packages to meet the specific needs of your business. You can choose which services you want to delegate to the PEO and which ones you want to handle in-house.

Q: Will I lose control over my business by partnering with a PEO?

A: No, partnering with a PEO does not mean you lose control over your business. You will still make the final decisions regarding your employees and your business operations